Is US Fed Fund Rate hiking a Boon/Bane?

The US Federal Reserve hiked interest rates for the third time this year by 25 basis points. It reaffirmed that it would further gradual hikes in 2019, with the committee signaling the end of an "accommodative" stance. The hike increases the federal funds rate from a range of 1.75 to 2 percent to a range of 2 to 2.25 percent, the highest level in a decade and likely to be felt by Americans who have a lot of debt or are seeking a bank loan. After the Fed boosts the federal funds rate, interest rates on credit cards, mortgages and small-business loans.

The U.S. economy is expected to grow 3.1 percent this year, the Fed said, which would be the first time the economy has topped the 3 percent mark for annual growth since 2005. Trump has repeatedly taken credit for the economy. US Fed raised interest rates last week by 25 basis points and signaled another hike in December and three more in 2019.

Fed’s view on US economy

The Fed sees the economy growing at a faster-than-expected 3.1 per cent this year and continuing to expand moderately for at least three more years, amid sustained low unemployment and stable inflation near its 2 per cent target.

Future rate hikes

Interest rates futures traders stuck with the projection that the Fed will hike interest rates in December, but expected two more hikes next year in contrast to Fed's estimate of three.

Trump’s reaction

Fed Chairman Powell in the press conference said that policymakers haven't been affected by political considerations. However, the central bank was again at the receiving end of the US President Donald Trump after the Central bank raised interest rates for the sixth time under the current administration. US President Donald Trump slammed the move, saying he was not happy about the rate hike. Fed chair Jerome Powell said the central bank was simply focusing on its mandate.

How does a US Fed rate hike impact emerging markets?

-

A hike in Fed rates will drive up the dollar's value against emerging market currencies.

-

The region would face higher financing costs for investment and higher effective discount rates, which would lower asset valuations and weaken the region’s corporate balance sheets.

-

Emerging markets are already reeling under the impact of this normalization of the Fed’s balance sheet and the repatriation of funds.

-

Emerging markets that run current account deficits, such as India; have seen their currencies depreciate sharply.

-

A falling local currency will eat into the returns of foreign investors.

-

Emerging economies try to take advantage of low-interest rates and borrow in US dollars.

-

During a period of dollar strength, any debt that is unhedged becomes more expensive to service.

Rising rates in the US would force emerging economies to increase their own rates, which would threaten financial stability. Canadians and folks in many other countries around the world affected by the U.S. rate rise, Powell made it very clear that his only concern is U.S. domestic policy. His message was effectively: countries that have large loans denominated in U.S. dollars will have to figure out how to deal with it.

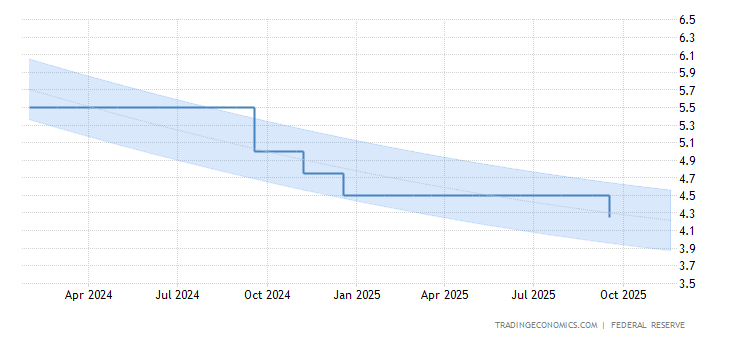

United States Fed Funds Rate – Forecast

Interest Rate in the United States is expected to be 2.50 percent by the end of this quarter. Looking forward, the estimate Interest Rate in the United States to stand at 3.00 in 12 month’s time. In the long-term, the United States Fed Funds Rate is projected to trend around 3.50 percent in 2020, according to the econometric models.

A rising rate environment is a boon for the financial sector, as it would bolster profits for banks, insurance companies, discount brokerage firms and asset managers. This is because they seek to borrow money at short-term rates and lend at long-term rates.